Car Road Tax Price Malaysia

List the price range according to these different factors and link externally to the JPJ website. A vehicle can be either private-owned or company-owned.

How Much Do You Know About Malaysian Road Tax Ezauto My

The R8 is one of Audis most famous cars to dateYou might recognise it from the Iron Man movies.

. Thank you for your understanding and reach out to us at 60 12-617 0351 if you have any other questions. Fixed Rate cars under 80kW Under 50kW. The road tax rate is calculated as follows starting with a base rate and an additional rate for each kW increase.

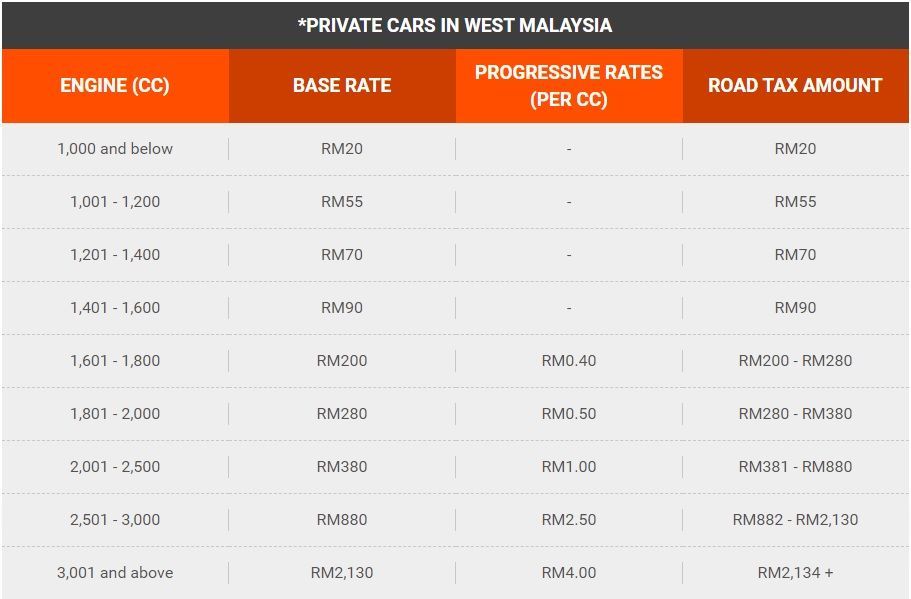

RM12048 Peninsular RM399940 Sabah and Sarawak Road tax for a company owned model. Price with 2021 SST Exemption. To calculate the road tax of a vehicle the base rate and progressive rate will have to be combined.

Given its a hatchback the Leafs base road tax would cost RM243 per year plus another RM88 in progressive charges bringing its total to RM331. 70kW 80kW. For the past few years Electric Vehicles EV like the Tesla Nissan Leaf and Renault Zoe have been enjoying a very low road tax rate as the Malaysian road transport department did not see a need to look throughly into this segment as there were so few EVs running around.

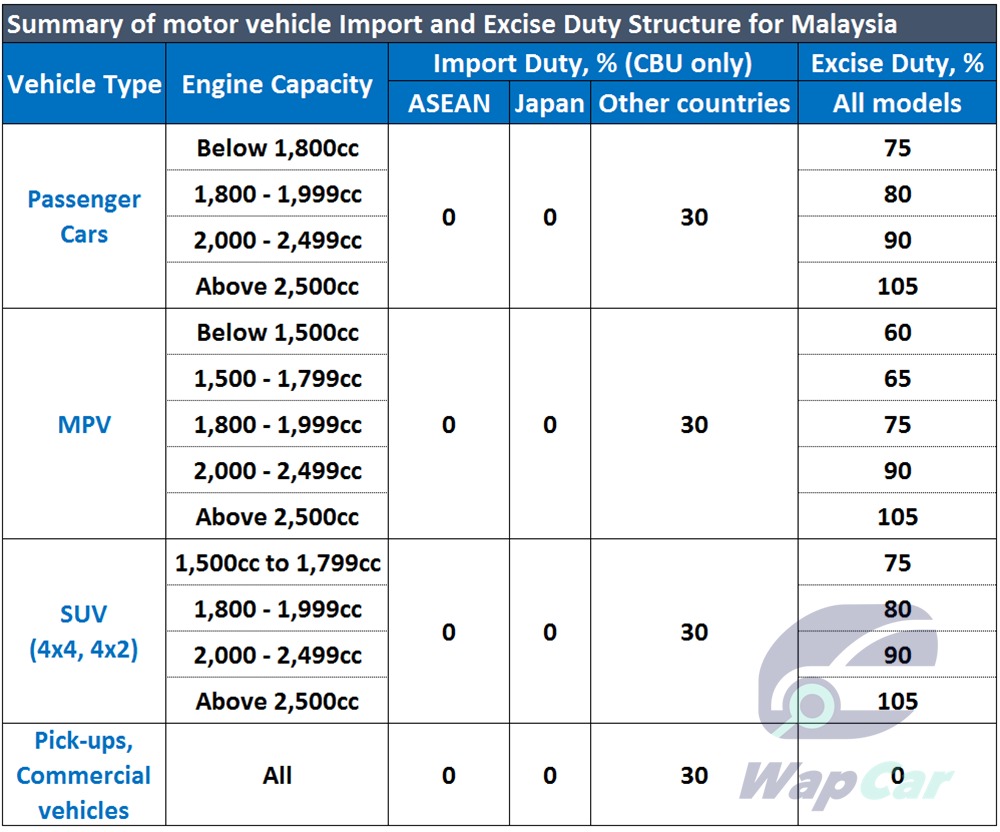

The tax can be as much as three times higher something to consider if you are planning on using a car loan calculator. Triton known as a commercial car 25 Quest MT 4X2. For example the road tax for a 13-litre sedan is different from a 20-litre sedan.

Motor Vehicle License LKM rates. Road Tax for Commercial Vehicles. The type of vehicle ownership will also affect the road tax rate.

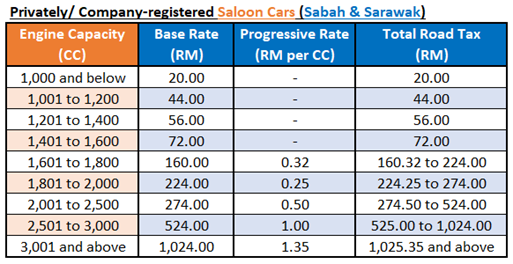

According to JPJ the cheaper road tax structure Sabah Sarawak is meant to compensate for any shortcomings that exist. Now with the slow but. Besides engine displacement another factor affecting road tax rates would be where your car is registered.

Road Tax Calculator Renew Road Tax Online with iMotorbike from RM14 only. Any Price Max RM 5000 RM 10000 RM 20000 RM 30000 RM 40000 RM 50000 RM 60000 RM 70000 RM 80000 RM 90000 RM 100000 RM 125000 RM 150000 RM 175000 RM 200000 RM 250000 RM 300000 RM 400000 RM 500000 RM 750000 RM 1000000 RM 1500000 RM 2000000. RM12 million Engine capacity.

Latest Car Roadtax Prices in Malaysia 2022 Car roadtax prices vary across cars. Road Tax for Private Car and Motorcycle. Use otomy to reach over 2000000 car buyers on Malaysias 1 automotive network.

With the displacement-based method the Proton X70 with a 18-litre TGDI is charged a road tax of RM 27960. Above 125 kW to 150 kW RM463 RM088 for every 005 kW increase from 125 kW RM 463 RM 176 RM 639. Otomy is the best way to buy and sell new used and reconditioned cars in Malaysia.

B erikut adalah senarai harga road tax kenderaan di Semenanjung Malaysia. Harga Roadtax Perodua Kembara 13-liter RM100 Axia 10-liter RM20 Viva 10-liter RM20 Myvi 13-liter RM70 Myvi 15-liter RM90 Kancil 850cc RM20 Kelisa 850cc RM20 Alza 15-liter RM90. Suppose your electric saloon generates a maximum output of 110 kW then you be paying a total road tax of RM 374 RM 274 base tax and a progressive tax of RM 100.

The road tax Porsche Taycan Turbo S locally for instance costs a hefty RM 12094 every year while Malaysians with a dream of owning a lightning-fast Tesla Model S Plaid will be starring down the barrel of an annual road tax bill that totals RM 17862. Covid-19 Notice Due to recent MCO announced all JPJs are not processing Road Tax renewal. If you use a company vehicle the odds are you will pay a higher road tax in Peninsular Malaysia.

Price of car. Price with SST. It is mandatory for every car owner in Malaysia to have a valid Motor Vehicle License LKM or roadtax to legally drive on Malaysian public roads.

Progressive Rate cars over 80kW. With the EV output-power-based calculation the Proton X70 with a 135 kW 184 PS would taxed as below. The calculation is quite fair and simple for cars under 80kW output.

24 VGT MT 4X4. Looking at the Road Tax Price for Cars in West Malaysia table Proton X70 that we are. If your vehicle has more than 1000cc youll be paying 50 less of the road tax price in East Malaysia Sabah Sarawak.

Motor Vehicle License LKM rates calculation guidelines for vehicles in Peninsular Malaysia Sabah and Sarawak is in this link. However the amount of tax imposed varies from one type of vehicle to another. 24 VGT AT 4X4.

Or find your next car amongst the quality listings at otomy. Road tax is even cheaper for cars in East Malaysia for both saloon and non-saloon cars. The vehicle use will also determine the road tax and it might also affect the result in the car insurance quotes.

Meanwhile in Labuan cars registered with an engine capacity of 1000cc or less pay a flat fee of RM20. The higher the displacement the higher the road tax is for a vehicle. However for cars above the 80kW output a progressive rate is imposed to the car road taxs calculation.

RM35764 Peninsular RM399940 Sabah and Sarawak FUN FACT. We share in this article the latest roadtax prices in Malaysia for a range of car brands and models. As for electric vehicles the road tax is based on the output figures.

While private saloons and sports cars are charged RM4cc upon exceeding 30 litres SUVs and MPVs are only charges RM160cc. Finding an EV that is large and practical enough to be a main vehicle but has a low enough power output to avoid progressive road tax charges will impossible. 60kW 70kW.

NEW Road Tax rates for EVs in Malaysia. 50kW 60kW. Even for those who decide in opting for a more humble set of eco-friendly wheels meanwhile.

The road tax rate is as follows. Progressive rate is capped at RM160 per cc only from 2500 cc onwards while a privately registered saloon car can be levied up to RM450 per cc from 3000 cc onwards. At minimum the road tax for an engine-driven car is RM20 for cars with engine displacements of 1000 cc and below.

Other electric cars For other electric cars including hatchbacks SUVs pick-ups coupes and crossovers and convertibles JPJ levies different rates of road tax. Above 80 kW to 90 kW RM165 and RM017 sen for every 005 kW 50 watt increase. 5204 cc Road tax for a privately owned model.

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

All You Need To Know About Road Tax Classic Car Status Insights Carlist My

Road Tax Paid To Jpj Don T Go To Road Maintenance So What Are We Paying For Wapcar

Ev Road Tax Structure In Malaysia How It S Calculated And How Rates Are Different For Sedans And Non Sedans Paultan Org

Topgear Ev Talk Why The New Tesla Model S S Road Tax Would Cost Rm17k In Malaysia

0 Response to "Car Road Tax Price Malaysia"

Post a Comment